Rapid Bridging Ltd are dedicated to supporting you at every stage of your application for a bridging loan. However, it’s vital that you personally understand the bridging loan application process, so we can help determine the ideal product for your needs.

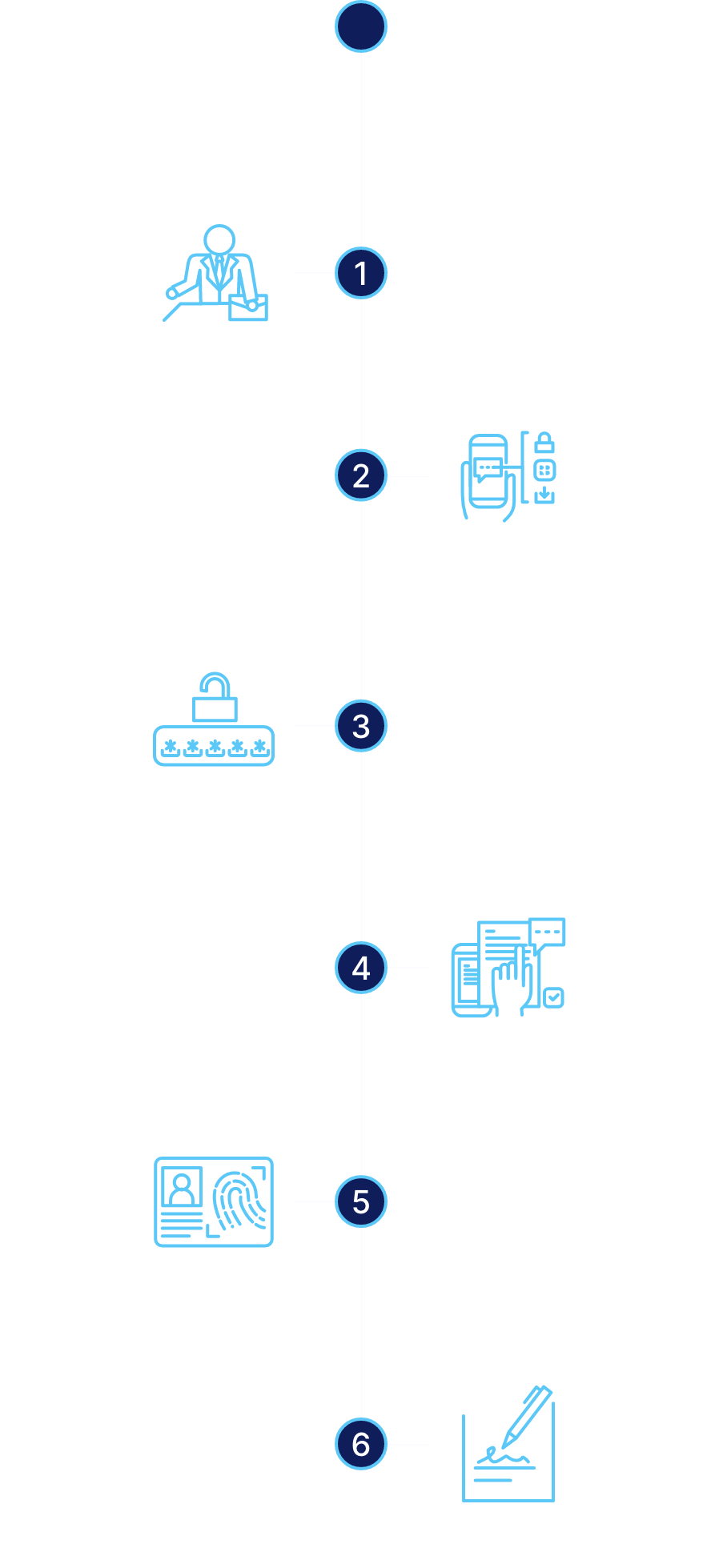

Our 6-step ‘Bridging Loan Process’ below explains the process, timescales and requirements for a typical bridging facility.

We are dedicated to supporting you at every stage of your application for a bridging loan, from initial advice through to completion.

Our onboarding process can be completed in under 30 minutes via our bank-grade secure app.

Can’t use the app? Get in touch and we’ll create a bespoke solution to meet your needs.

Here’s how our app works:

For regulated bridging loans the typical APR is 14.60% based on a loan size of £250,000 and fixed for 12 months, regulated bridging loans are for a maximum term of 12 months.

COMMERCIAL AND DEVELOPMENT BRIDGING LOANS ARE NOT REGULATED BY THE FINANCIAL CONDUCT AUTHORITY. YOUR HOME MAY BE REPOSSESSED IF YOU DO NOT KEEP UP PAYMENTS ON YOUR MORTGAGE. THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME.CHECK THAT THIS MORTGAGE WILL MEET YOUR NEEDS IF YOU WANT TO MOVE OR SELL YOUR HOME OR YOU WANT YOUR FAMILY TO INHERIT IT. IF YOU ARE IN ANY DOUBT, SEEK INDEPENDENT ADVICE.

WE ARE A CREDIT BROKER, NOT A LENDER. WE WILL RECEIVE COMMISSION FROM LENDERS. DIFFERENT LENDERS PAY DIFFERENT AMOUNTS DEPENDING ON DIFFERENT COMMISSION MODELS. FOR TRANSPARENCY WE WORK WITH THE FOLLOWING COMMISSION MODEL: PERCENTAGE OF THE AMOUNT YOU BORROW AND RATE FOR RISK (THIS IS BASED ON THE RISK PROFILE Of THE BUSINESS) FURTHER DETAILS OF THE COMMISSION MODEL, CALCULATION AND AMOUNT WILL BE DISCLOSED TO YOU THROUGHOUT YOUR CUSTOMER JOURNEY.